The Spokesperson and Economic Adviser to the Vice President, Dr Gideon Boako has challenged Bright Simons and Franklin Cudjoe to apologize for some misleading comments they made regarding Vice President Bawumia’s statement on the credit scoring system in Ghana.

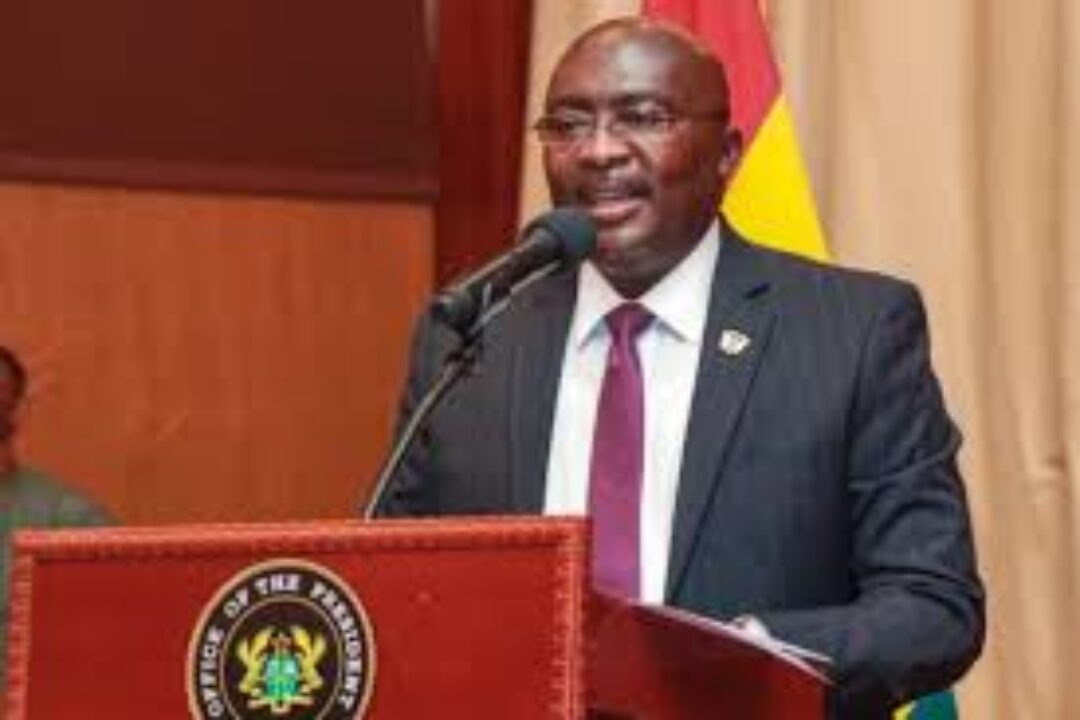

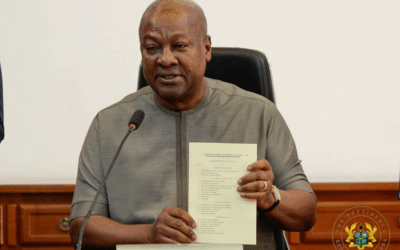

While addressing the 57th graduation of the Kwame Nkrumah University of Science and Technology (KNUST) last week, Vice President Bawumia extolled the many usefulness of the Ghana card in helping the country establish a robust credit scoring system to track and uniquely identify all borrowers.

But in a sharp response, the Vice President of IMANI Africa, a Think Tank, downplayed the accuracy of the information put out by the Vice President.

This was backed by other leaders of IMANI, including its President, Franklin Cudjoe.

The two made references to a credit bureau company, XDSDATA Ghana Limited, arguing that the agency has the system the Vice President was talking about already in place.

However, XDSData Ghana Limited, a leading credit bureau in Ghana, has clarified through a press release that it has not produced individual credit scores in the country.

In view of this, Dr. Boako, in a separate post on Twitter and Facebook, challenged the two to eat the humble pie and apologise to the many Facebook and Twitter users their comments reached.

According to the Managing Director of XDSData, George K. Ahiafor, Ghana Card penetration, a potential unique identifier, is currently at 35%, as indicated by tracking from the Bank of Ghana (BoG).

Mr. Ahiafor anticipates that XDSData will start releasing individual credit scores when Ghana Card penetration reaches 90%, hopefully by the end of the year 2024.

Presently, facilities are accessed using various forms of identification, making it challenging for the bureau to capture a credit subject’s total exposure accurately.

However, Mr. Ahiafor emphasized that XDSData produces credit information comparable to international credit bureaus, providing adequate data for lenders to make informed credit decisions.

He disclosed that the mandatory use of the Ghana Card for all financial transactions since July 1, 2022, has led to Data Providers submitting Ghana Card information to the bureau.

He said credit scoring models require unique identifiers for comprehensive mapping of information, and the slow pace of Ghana Card information penetration remains a challenge.

Mr. Ahiafor highlighted the importance of active participation and support from the Bank of Ghana to ensure credit bureaus receive adequate Ghana Card data from Data Providers.

He explained that this collaborative effort aims to incorporate all aspects of the credit ecosystem into scoring calculations.

Meanwhile, Ghana is set to introduce a credit scoring system for individuals next year, with the Ghana Card becoming the anchor for the credit system.

Vice-President Dr. Mahamudu Bawumia has indicated ongoing discussions with Ghanaian automobile companies to enable citizens to purchase cars on credit, with Solar Taxi being one of the companies participating in the initiative.

The planned credit scoring system is expected to provide a credible credit history, enhancing trust and discipline in the financial sector.

The announcement has generated serious debate in the country with some claiming that individual credit scores is being done already necessitating XDSData to set the record straight .

In the complex world of personal finance, a numerical representation known as a credit score holds immense power in shaping an individual’s financial journey.

This score, a depiction of one’s creditworthiness, is derived from a careful analysis of various factors: repayment history, types of loans, length of credit history, debt utilization, credit mix, and whether an individual has applied for new accounts.

A credit score plays a key role in a lender’s decision to offer credit and determine associated terms.

Lenders use an individual’s credit score to assess eligibility for products like mortgages, personal loans, and credit cards, influencing the interest rates they will pay.

The significance of a credit score in an individual’s financial life cannot be overstated.

A higher credit score enhances the likelihood of loan approval and secures more favorable interest rates.

Conversely, lower credit scores may lead to declined loan applications or higher interest rates.

Lenders are inclined to approve individuals with higher credit scores for loans with lower interest rates, reflecting a perception of lower risk.

On the contrary, those with lower scores may face challenges in obtaining credit or may encounter less favorable terms.

Understanding the dynamics of credit scores empowers individuals to make informed financial decisions.

Regularly monitoring one’s credit report, ensuring accuracy, and actively working towards improving creditworthiness can have a profound impact on long-term financial well-being.

In essence, a higher credit score not only opens doors to financial opportunities but also translates into potential savings over time.