Bank of Ghana Governor (BoG), Dr. Johnson Asiama, says the cedi’s days of excessive volatility against the dollar are coming to an end.

Speaking to Joy Business’ on the sidelines of the IMF/World Bank Spring Meetings in Washington D.C., Dr. Asiama assured that the central bank would continue implementing measures to preserve the current stability of the Ghana cedi.

“Going forward, we have enough reserves to maintain the current stability the cedi is enjoying against the US dollar,” Dr. Asiama stated.

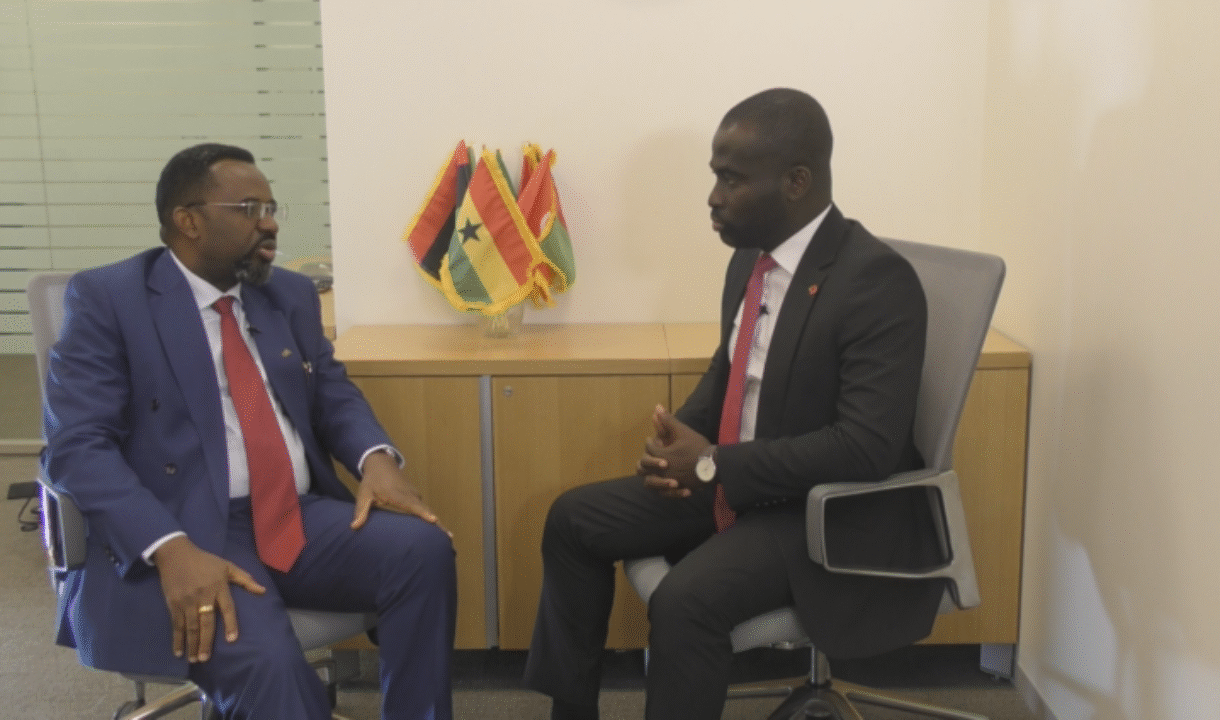

Dr. Johnson Asiama(left) interacting with the Journalist

However, he was quick to add, “The Bank of Ghana is not going to operate a fixed exchange rate regime.

The cedi is an endogenous variable, and we must allow it to float. What the Bank of Ghana aims to do is ensure there is no excessive volatility.”

Reasons Behind the Cedi’s Stability

The Ghana cedi has recorded one of its longest periods of stability against the US dollar in recent times. Since December 2024, the local currency has remained largely stable, even appreciating against the dollar on some days.

Data from the Bank of Ghana and some commercial banks show that, as of April 2025, the cedi had appreciated by 2.76 per cent against the dollar.

Bloomberg’s currency platform reported that as of April 28, 2025, most commercial banks were selling the dollar at GH¢15.58, with some quoting GH¢15.40 today.

Market analysts have attributed the cedi’s resilience to several factors, including active liquidity support from the central bank and BoG’s Gold Purchase Programme, which has boosted market confidence and curbed speculative activities.

The International Monetary Fund (IMF) also highlighted Ghana’s stronger-than-expected international reserve buildup.

According to the Bank of Ghana’s Economic and Financial Data, international reserves reached $9.3 billion at the end of February 2025, significantly exceeding targets set under the IMF’s Extended Credit Facility (ECF)-supported programme.

Governor’s Perspective on the Cedi’s Performance

Dr. Asiama outlined key reasons behind the currency’s stability:

- Improved external sector performance, supported by strong remittances and better earnings from gold and cocoa exports.

- Effective coordination between fiscal and monetary policy ensures that both sides work harmoniously to strengthen economic fundamentals.

- Weaker US dollar performance globally has created favourable conditions for the cedi.

He emphasised, “The fiscal side has been supportive of monetary measures, helping to maintain the current development.”

Impact of the IMF Programme

The BoG Governor also noted that the recent Staff Level Agreement with the IMF has played a crucial role in boosting investor confidence.

“The Staff Level Agreement with the IMF was like a stamp of approval for the government’s efforts to restore macroeconomic stability,” Dr. Asiama explained.

He added that discipline on both the fiscal and monetary fronts continues to help reset market expectations and restore confidence.

Impact on Inflation

Dr. Asiama expressed optimism that the cedi’s improved performance would contribute to a further slowdown in inflation in the coming months.

“This should be complemented by the monetary measures the Bank of Ghana is implementing to continue driving inflation lower,” he stated.Source: George Wiafe, Special Correspondent, Washington D.C., USA