This Article is a comparison between Ghana and peer countries on Duty-free Zones, what peer countries have done better or worse, and what policies seem to make the difference.

- Impact & Scale

Nigeria has large numbers of Duty-free Zones, huge investment totals, and significant jobs created, however, the benefits to SMEs are less clear in terms of inclusion. Some zones are extremely capital intensive, limiting jobs growth as well as limiting SMEs participation.

Vietnam, though having many Duty-free Zones, seems to show clearer evidence of spillovers for local businesses, firms and SMEs: shifting employment from agriculture, raising formal employment, and increasing earnings for people even outside foreign firms.

Ghana appears somewhere between moderate scale, meaningful growth in jobs and exports, increasing local ownership in zones(around 36%), welfare spillovers.

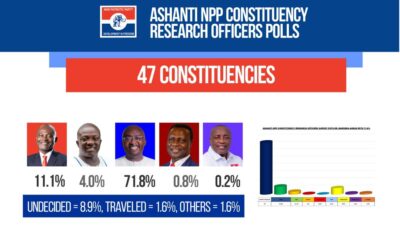

The growth of Duty-free Zones in Ghana from 2020-2023 under Hon. Alan Kyerematen as Trade Minister suggest that Ghana is getting clear momentum for the establishment of more additional Duty-free Zones across the Country, and this was rightly in alignment with Alan Kyerematen’s vision for the African Continental Free Trade Area(AfCFTA).

- Policy Incentives, Institutional Quality and Limitations

All the three Countries, Ghana, Nigeria, and Vietnam used tax breaks, duty exemptions, land & infrastructure incentives etc. But the regimes vary in transparency, stability, enforcement, and duration. However, Vietnam has demonstrated that where institutions are strong, SME Spillovers are more positive, and where institutional quality is weak, domestic SMEs may suffer from competition with foreign businesses without benefiting.

Kenya has recently started placing limits on how long incentives should last.

Nigeria has issues with overlapping legislation and regulatory bottlenecks.

Ghana is pushing more for local content and ownership but also faces challenges in enforcement.

- Local Content, Ownership & Supply Chains

SME participation in supply chains is very crucial.

Vietnam’s Industrial parks and zones often force or incentivize sourcing locally or at least enabling domestic firms to support foreign firms operating in Duty-free zones or enclaves.

Nigeria has domestically generated investment(DDI) but SMEs still lack access to large contracts or may be constrained by scale, technology and skills.

Ghana has been trying to increase local share, and around one third of firms in Duty-free Zones are either wholly owned Ghanaian or partly owned Ghanaian. This increases the chance that SMEs can participate, but it is still limited.

From the comparison, the following policy elements and actions show up in countries where SMEs and local businesses benefit from Duty-free Zone Policy:

1. Strong, and clear institutional or regulatory frameworks

Rules about incentives, duties, customs, and tax regime need to be consistent, enforced, and transparent. Duration of incentives should be credible and limited(widely known as Sunset).

Excellent local institutions help to ensure spillovers just like in the case of Vietnam.

- Local Ownership and Local Content Requirements

Requiring as well as strongly encouraging a proportion of businesses/firms in the Duty-free Zones to be locally owned or joint ventures.

Mandating or encouraging sourcing of inputs from local SMEs with the appropriate support to meet quality & volume so that supply chains are localized.

- Support for SMEs to Meet Standards and Compliance

Training, industrial capacity building, access to finance, and technology transfer are needed to increase SMEs participation in the Duty-free Zone Policy.

Also, assistance with complying with export standards, quality, environmental safety etc, which many SMEs struggle with.

- Access to Affordable Inputs and Infrastructure

Cheap Energy, land, reliable utilities, good transport and logistics, and streamlined licensing are essential for the survival of Duty-free Zone Policy. -

Proximity and Spillover Planning

Ghana’s evidence of welfare gains within 30km under the Duty-free Zone Policy already in implementation across the country suggests that, proximity and spillover planning matters.

Planning Duty-free Zones so that local communities are close enough to benefit in terms of jobs and opportunities creation is very important.

- Sound Economy, Balanced Incentives and Fiscal Sustainability

Under the Duty-free Zone Policy, governments need to weigh the revenue costs of tax breaks and exemptions versus the benefits, as well as ensure that the incentive regimes are not so generous as to undermine domestic businesses outside the zones.

Also, governments should be able to prudently managed Exchange Rates, Policy Rates, Interest Rates, and Inflation Rates under the fiscal and monetary sustainability frameworks. For example, a Duty-free Zone Policy under $1 to 17ghc may struggle to survive.

- Monitoring, Evaluation, and Adjustment

Regular measuring of zones performances in the areas of jobs creation, exports, ownership, linkages, capital flight, and poverty effects on the citizens especially the local communities, and accordingly adjust the Duty-free Zone Policy. -

Collect better disaggregated data on firm size, ownership, export versus domestic sales, local versus foreign competition, as well as keenly monitoring which firms are benefitting and which firms are not benefitting.

Conclusion

Therefore, we can authoritatively conclude that, Dr. Mahamudu Bawumia’s promise of 1 Region 1 Duty-free Zone is NOT NEW. The policy is already in existence in Ghana since 1995, and Hon. Alan Kyerematen did a marvelous job around that Policy during his tenure as Minister of Trade and Industry and Board Chairman of Ghana Free Zones Authority.

Also, in terms of economic and business activities, it is NOT economically wise to have Duty-free Zone Policy in all the 16 Regions of Ghana, putting a serious consideration on Value for Money Analysis.

….Signed….

Razak Kojo Opoku(PhD)

Founding President of UP Tradition Institute